Sam Bankman-Fried and FTX Fraud Schemes Explained

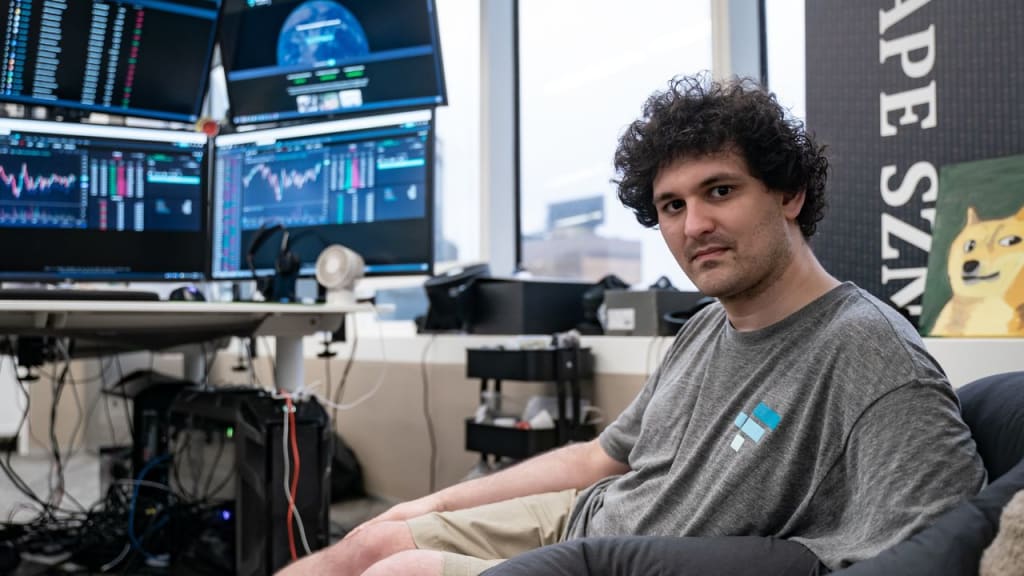

Sam Bankman was born into the elite enclave of Stanford law professors, it was almost preordained that his life would be nothing short of extraordinary. For those unfamiliar with Stanford University, it's a crucible of innovation that has given birth to international entrepreneurs and molded the minds of influential politicians.

Sam Bankman was born into the elite enclave of Stanford law professors, it was almost preordained that his life would be nothing short of extraordinary. For those unfamiliar with Stanford University, it's a crucible of innovation that has given birth to international entrepreneurs and molded the minds of influential politicians.

This crucial piece of history is essential to our narrative because we're about to delve into the remarkable journey of an individual who, in just a matter of years, went from being a physics undergrad to securing the sixth spot on Forbes' list of the world's wealthiest with a net worth of $26.5 billion. He's also credited with establishing the third-largest cryptocurrency exchange valued at a staggering $32 billion. But there's more to this story than just financial milestones.

Ladies and gentlemen, allow us to introduce you to an extraordinary figure from the Silicon Valley - Sam Bankman.

FTX: A Meteoric Ascent in the Crypto Sphere

At the age of 25, Sam Bankman embarked on his ambitious project, which, in just over two years, evolved into a shining star in the realm of cryptocurrency. This project materialized as a cryptocurrency exchange platform named FTX, securing a substantial $40 million investment in 2019 and achieving a valuation of slightly over a billion dollars right from the start. As the company embarked on its journey, it surged ahead, moving from daily trading volumes in the millions to the tens and hundreds of millions. As it approached its zenith, it reached an astounding valuation of $1 billion, firmly establishing itself as one of the world's top three cryptocurrency exchanges, with a daily influx of 10 million users and a colossal trading volume of $20 billion.

At the age of 25, Sam Bankman embarked on his ambitious project, which, in just over two years, evolved into a shining star in the realm of cryptocurrency. This project materialized as a cryptocurrency exchange platform named FTX, securing a substantial $40 million investment in 2019 and achieving a valuation of slightly over a billion dollars right from the start. As the company embarked on its journey, it surged ahead, moving from daily trading volumes in the millions to the tens and hundreds of millions. As it approached its zenith, it reached an astounding valuation of $1 billion, firmly establishing itself as one of the world's top three cryptocurrency exchanges, with a daily influx of 10 million users and a colossal trading volume of $20 billion.

Yet, what truly enticed individuals seeking swift profits were the derivatives offered on the exchange. These derivatives enabled users to acquire tokens with leverage, allowing them to profit significantly from price fluctuations. For instance, if a token's price surged by 10%, users stood to gain a remarkable 30%. However, the downside was equally formidable: a downturn could result in substantial losses.

A relentless marketing campaign ensured that, within less than three years, the project blossomed into a technological behemoth, attracting billions of dollars and millions of users.

Nevertheless, all success stories have their concluding chapters, and in this case, it culminated with the vanishing of $9 billion belonging to customers.

FTX's $9 Billion Scam Unraveling: A Deceptive Scheme

So, how does one steal $9 billion? To simplify the complex, let's break it down. People come to a cryptocurrency exchange to acquire assets, such as buying shares that will hopefully appreciate in value. For these transactions, the exchange charges a fee. In the era of the internet and derivatives, things became more intricate, but the fundamental idea remained the same. The exchange is essentially a marketplace that facilitates buying and selling while securely profiting from these transactions. Users' assets are stored in accounts on this marketplace, ensuring they don't have to carry around physical assets.

The FTX and Alameda Connection

Consider FTX, a cryptocurrency exchange that, at its discretion, used client funds for real estate investments, cryptocurrency research, and charitable projects. This scheme is brilliantly simple, grotesque, and vile, all at once.

In this story, there's not just FTX; there's also its sister company, Alameda Research, which was involved in cryptocurrency trading but was not a cryptocurrency exchange. FTX couldn't even open a bank account because banks were hesitant to deal with anything crypto-related. Therefore, FTX proposed to its customers that they send money directly to Alameda Research to fund their accounts, even though the two entities were not officially connected.

Alameda's Debt Accumulation

Instead of forwarding these funds to FTX, Alameda stored them in its own accounts, accumulating a staggering debt of $8 billion to the cryptocurrency exchange. Why wasn't the cryptocurrency exchange concerned? The official response from FTX was that Alameda provided them with high-quality collateral, represented by a "super-valuable" cryptocurrency coin called FTT.

Instead of forwarding these funds to FTX, Alameda stored them in its own accounts, accumulating a staggering debt of $8 billion to the cryptocurrency exchange. Why wasn't the cryptocurrency exchange concerned? The official response from FTX was that Alameda provided them with high-quality collateral, represented by a "super-valuable" cryptocurrency coin called FTT.

The Risky Nature of FTT

In essence, FTT is not a dollar, it's not a stable coin, it's not even Bitcoin or Ethereum; it's a cryptocurrency coin created by FTX itself, with a relatively small market capitalization. This means its price can be easily manipulated. If a large player bought 200 million FTT tokens, the price could double. Often, the buyer was none other than Alameda, artificially inflating the value. As a result, users' assets were transferred to another company as collateral, twice the original amount.

A Fragile House of Cards

This scenario bears an uncanny resemblance to a soap bubble or a house of cards. If a significant sell-off were to occur, FTT's value would plummet, which, in turn, would decrease the exchange's collateral. This would lead to additional sell-offs, eventually causing the pyramid to crumble and potentially driving the company into bankruptcy.

How FTX Exchange Went Bankrupt: The Chain Reaction

You might be surprised to learn that the multi-billion-dollar crypto empire began to crumble not because of a criminal investigation or any governmental allegations. Instead, it all came down to a few paragraphs in an article published on November 2nd. This article revealed that nearly 90% of Alameda's net assets, the sister company of FTX, consisted of FTT tokens. What's striking is that a significant portion of the clean capital in Alameda's business was effectively a token printed out of thin air, centrally controlled by FTX.

Binance's Move

Just two days after this article was published, Changpeng Zhao, the head of the Binance cryptocurrency exchange platform, who is also considered one of the most influential influencers in the crypto world, publicly announced that Binance was unloading the remainder of its FTX tokens. This fact, which arose shortly after the article's publication, greatly alarmed regular users. The reported amount of the impending sale was close to $600 million. This poses an interesting philosophical question.

Just two days after this article was published, Changpeng Zhao, the head of the Binance cryptocurrency exchange platform, who is also considered one of the most influential influencers in the crypto world, publicly announced that Binance was unloading the remainder of its FTX tokens. This fact, which arose shortly after the article's publication, greatly alarmed regular users. The reported amount of the impending sale was close to $600 million. This poses an interesting philosophical question.

On one hand, Binance openly declared a significant upcoming transaction, demonstrating transparency and honesty. Binance even intends to spread these sales over a month to avoid impacting the market significantly. However, on the other hand, Binance is a competitor to FTX. This seems like the ideal moment. If FTX isn't entirely clean, there's a high chance that the death spiral will spin, bringing the competitor to its knees. And that's precisely what transpired.

Within three days, the exchange experienced an unprecedented withdrawal of $6 billion in assets, causing the token's price to plummet by 90%. On November 7th, Sam Bankman-Fried tried to reassure the public that everything was fine with the assets, but he later deleted the tweet. Four days later, FTX filed for bankruptcy. The day ended with a poignant tweet from Sam, "Sorry, I f***ed up."

The Fall from Grace

The empire that was valued at $26.5 billion at its peak almost vanished within a week. The philanthropist's image was replaced by that of a fraudster. A stable exchange turned into a pyramid scheme that triggered the bankruptcy process, and the life of the man who created this multi-billion-dollar empire was now in jeopardy.

But the central question remains: How did he manage to build such a multi-billion-dollar empire? Who believed in him, and who was behind it all?

Why Did People Trust Sam Bankman?

The first reason Sam was able to lure investors was that he had something to show them. Remember Alameda Research? It was created before the ill-fated exchange. Its founders ran around showing investors their consistent returns of 110%, even when Bitcoin and Ethereum were in a slump. In essence, they were offering good returns with seemingly no risk.

Sam's Image and Reputation

This, coupled with the image and reputation of Sam, who dressed modestly and carried himself like a scholar, all played a role in captivating investors. They saw a new Steve Jobs in him, someone passionate about his ideas and delivering results in his niche.

Now, if you still wondering how investors could put their money into a venture helmed by a sociopath and a swindler, remember that just a few months ago, these so-called "smart" investors entrusted their funds to him. Despite Sam playing computer games during presentations (a true story from a conference), investors poured what they called "smart money" into FTX.

The Power of Family Connections

But we're not quite finished yet. There's another reason Sam was able to win their trust: his parents. For several decades, Sam's parents have been teaching law at Stanford. Over time, they built an impeccable reputation and a vast network among future investors and IT entrepreneurs. You see, Stanford is already a hotbed of networking, and when your parents have been part of that environment for quite some time, access to people and money multiplies significantly.

But we're not quite finished yet. There's another reason Sam was able to win their trust: his parents. For several decades, Sam's parents have been teaching law at Stanford. Over time, they built an impeccable reputation and a vast network among future investors and IT entrepreneurs. You see, Stanford is already a hotbed of networking, and when your parents have been part of that environment for quite some time, access to people and money multiplies significantly.

This is just one example: Orlando Bravo is an investor in FTX. Guess what? Back in the '90s, he was studying at Stanford. Can you guess who his professor was? That's right, it was none other than Joseph Bankman, Sam's father.

One other essential factor was the history and reputation of Sam's parents, which were instrumental in opening doors and attracting investments. His father, Joseph Bankman, worked as a top adviser in the shadows of FTX. This fact remained hidden from the public until the legal investigations came to light.

Joseph Bankman wasn't just involved in managing the company's taxes. He was also actively involved in marketing both FTX and its token, FTT. Due to the misuse of this token, everything started to unravel.

But Joseph was more than a mere shadowy figure in the background. He played a pivotal role, quietly influencing decisions within FTX. In addition to being an expert on financial matters, he also held a Ph.D. in clinical psychology. With his deep understanding of human nature, it's easy to see how he could find his way into people's minds.

Awarded a handsome salary of $200,000 and a gift of $10,000,000 from his son, Joseph Bankman was rewarded handsomely for his unique services. And with his family's newfound wealth from FTX, they acquired an opulent residence in the Bahamas worth $16 million. Sam's mother also enjoyed private jet travel and only stayed in the finest VIP hotels with rates at $1,200 per night. And all of this was funded by the money of FTX users.

This is why, among other charges, both of Sam's parents are also being sued for embezzlement, misappropriation of funds, and other financial crimes.

Unmasking Sam Bankman-Fried: The Conclusion to the FTX Saga

In the conclusion of the FTX saga, we witnessed a shocking revelation about Sam Bankman-Fried. His actions turned out to be an intricate web of lies, and beneath his seemingly saintly exterior lay the true nature of a sociopath.

In the conclusion of the FTX saga, we witnessed a shocking revelation about Sam Bankman-Fried. His actions turned out to be an intricate web of lies, and beneath his seemingly saintly exterior lay the true nature of a sociopath.

In the wake of such a catastrophic sequence of events, one can only imagine the emotional turmoil that Sam found himself in. The loss of a business empire, financial wealth, and a once-pristine reputation sent him into a tailspin of stress and despair. It was in this vulnerable state that our protagonist, Sam, decided to come clean. For example, Sam, in an interview with Vox, renounced the regulators, accusing them of making things worse, and admitted that his public endorsement of cryptocurrency exchange regulation was just a PR stunt.

Stars like Sam shine brightly but not for long. He played with other people's money and, despite his appealing speeches to cover his losses, he's likely to end up in prison, at least he must.

On October 3, hearings began in the case of Sam Bankman-Fried. The maximum sentence for crimes committed is 110 years.

At the time of writing, the outcome is unknown.